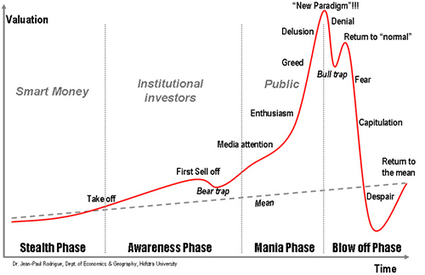

Let’s walk through the logic. The most reasonable estimates suggest that, given a crash program and the best foreseeable technologies, renewable sources can probably provide the United States with around 15% of the energy it currently gets from fossil fuels. Since every good and service in the economy is the product of energy, it’s a very rough but functional approximation to say that in a green economy, every American will have to get by on the equivalent of 15% of his or her current income. Take a moment to work through the consequences in your own life; if you made $50,000 in 2009, for example, imagine having to live on $7,500 in 2010. That’s quite a respectable income by Third World standards, but it won’t support the kind of lifestyle that the vast majority of Americans, across the political spectrum, believe is theirs by right.

That’s the bomb ticking away at the heart of America’s political system. When it goes off, the entire system of government by pork barrel will explode messily, and it’s only in the fantasies of reformers that what replaces it will likely be any improvement. (My guess? Anything from a military coup followed, after various convulsions, by a new and less centralized constitution, to civil war and the partition of the United States into half a dozen impoverished and quarreling nations.) In the meantime, we can expect to see every possible short term expedient put to use in an attempt to stave off the explosion even for a little while, and any measure that might risk rocking the boat enough to set off the bomb will be quietly roundfiled by all parties.

A meaningful political response to the growing instability of global climate is one such measure, and a meaningful political response to peak oil is another. No such project can be enacted without redirecting a great deal of money and resources away from current expenditures toward the construction of new infrastructure. The proponents of such measures are quick to insist that this means new jobs will be created, and of course this is true, but they neglect to mention that a great many more existing jobs will go away, and the interests that presently lay claim to the money and resources involved are not exactly eager to relinquish those. A political system of centralized power could overcome their resistance readily enough, but a system in which power is diffused and fragmented cannot do so. That the collapse of the entire system is a likely long-term consequence of this inability is simply one of the common ironies of history.

--> http://www.energybulletin.net/51089

--> http://thearchdruidreport.blogspot.com/2009/12/political-ecology-of-collapse-part.html

--> http://thearchdruidreport.blogspot.com/2009/12/political-ecology-of-collapse.html

--> http://thearchdruidreport.blogspot.com/2009/12/human-ecology-of-collapse.html

![[$SPX-Ewave1.png]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiYX5Nnmz1fq3eT0v_-gP1z3KCJ5AoVZk84YAIYTbEWcseWyPqFvccUIZiFTZJv2jQi00JZU8boMFUGZs-syayt9a-UO8UpSGH1HQs4uSjZSM4F4CElwSL0YbvsFdU8ed29u39G8dy0q7-M/s1600/$SPX-Ewave1.png)