| NEW! Google search DU or the Web |

STOCK MARKET WATCH, Thursday October 15

| |

| Home » Discuss » Latest Breaking News |  |

| ozymandius | Thu Oct-15-09 09:29 AM Original message |

| STOCK MARKET WATCH, Thursday October 15 |

| Printer Friendly | Permalink | Reply | Top |

| |

| ozymandius | Thu Oct-15-09 09:35 AM Response to Original message |

| 1. Market Observation |

| Printer Friendly | Permalink | Reply | Top |

Ghost Dog  | Thu Oct-15-09 11:13 AM Response to Reply #1 |

| 12. Only / Vaulting ambition, which o'erleaps itself... |

| Printer Friendly | Permalink | Edit | Reply | Top |

Tansy_Gold  | Thu Oct-15-09 12:07 PM Response to Reply #12 |

| 17. Didn't I ask about this just last week or so? |

| Printer Friendly | Permalink | Reply | Top |

Demeter  | Thu Oct-15-09 03:49 PM Response to Reply #17 |

| 32. And You Can Bet They Don't Pay US Tax on THose Profits, Either |

| Printer Friendly | Permalink | Reply | Top |

Demeter  | Thu Oct-15-09 02:08 PM Response to Reply #12 |

| 24. You Said It |

| Printer Friendly | Permalink | Reply | Top |

| ozymandius | Thu Oct-15-09 09:39 AM Response to Original message |

| 2. Today's Reports |

| Printer Friendly | Permalink | Reply | Top |

| ozymandius | Thu Oct-15-09 09:41 AM Response to Original message |

| 3. Oil jumps to fresh 1-year high above $75 a barrel |

| Printer Friendly | Permalink | Reply | Top |

| ozymandius | Thu Oct-15-09 09:43 AM Response to Original message |

| 4. Foreclosures rise 5 percent from summer to fall |

| Printer Friendly | Permalink | Reply | Top |

Roland99  | Thu Oct-15-09 10:58 AM Response to Reply #4 |

| 8. Subprime and the Banks: Guilty as Charged |

| Printer Friendly | Permalink | Reply | Top |

| tclambert | Thu Oct-15-09 11:10 AM Response to Reply #4 |

| 11. Dear Mr. President, IT'S ALL ABOUT JOBS!! |

| Printer Friendly | Permalink | Reply | Top |

Tansy_Gold  | Thu Oct-15-09 12:10 PM Response to Reply #11 |

| 19. that goes back to the question I asked upthread |

| Printer Friendly | Permalink | Reply | Top |

| janedum (188 posts) | Thu Oct-15-09 12:47 PM Response to Reply #11 |

| 20. Mr. President LOVES Wall Street. DOW $10,000 for Wall St., $0.00 for Main Street. |

| Printer Friendly | Permalink | Reply | Top |

DemReadingDU  | Thu Oct-15-09 03:14 PM Response to Reply #20 |

| 31. NPR 10/15/09 business segments |

| Printer Friendly | Permalink | Reply | Top |

| ozymandius | Thu Oct-15-09 09:52 AM Response to Original message |

| 5. Asian markets extend rise after Dow passes 10,000 |

| Printer Friendly | Permalink | Reply | Top |

| ozymandius | Thu Oct-15-09 09:58 AM Response to Original message |

| 6. New Light on Emails by BofA Directors |

| Printer Friendly | Permalink | Reply | Top |

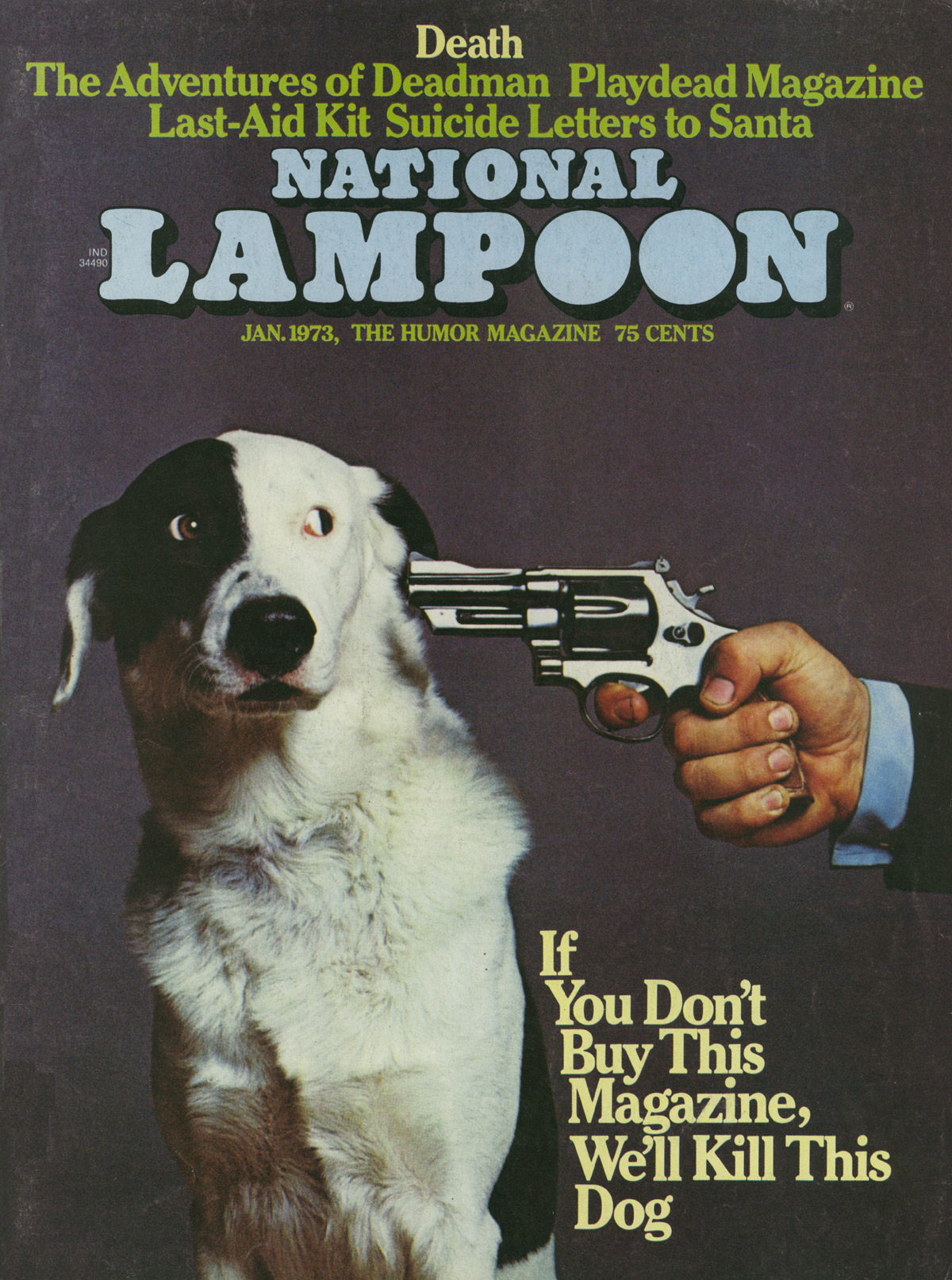

| truthisfreedom (1000+ posts) | Thu Oct-15-09 10:45 AM Response to Original message |

| 7. Weird cartoon. Someone want to explain it to me? |

| Printer Friendly | Permalink | Reply | Top |

Roland99  | Thu Oct-15-09 10:59 AM Response to Reply #7 |

| 9. I take it to mean we're screwed without real reform. |

| Printer Friendly | Permalink | Reply | Top |

DemReadingDU  | Thu Oct-15-09 11:04 AM Response to Reply #7 |

| 10. Insurance is going to raise rates |

| Printer Friendly | Permalink | Reply | Top |

Dr.Phool  | Thu Oct-15-09 11:17 AM Response to Reply #7 |

| 13. Kinda like this. |

| Printer Friendly | Permalink | Reply | Top |

Tansy_Gold  | Thu Oct-15-09 11:46 AM Response to Reply #7 |

| 15. I think the second balloon should've been. . . . |

| Printer Friendly | Permalink | Reply | Top |

Demeter  | Thu Oct-15-09 03:52 PM Response to Reply #7 |

| 33. Health Insurance Companies Have a "Captive" Market |

| Printer Friendly | Permalink | Reply | Top |

wordpix (1000+ posts)  | Thu Oct-15-09 06:49 PM Response to Reply #33 |

| 50. and said captives are screwed one way or the other, since the insurance lobby is one big monopoly |

| Printer Friendly | Permalink | Reply | Top |

AnneD (1000+ posts)  | Thu Oct-15-09 07:17 PM Response to Reply #7 |

| 51. Remember how the Banks and WS types said ........ |

| Printer Friendly | Permalink | Reply | Top |

rfranklin  | Thu Oct-15-09 11:32 AM Response to Original message |

| 14. Futures drop after Goldman announces $3.19 billion quarter... |

| Printer Friendly | Permalink | Reply | Top |

| Po_d Mainiac | Thu Oct-15-09 11:49 AM Response to Reply #14 |

| 16. I suspect it has more to do with the "unexpected/surprise" loss at NOK |

| Printer Friendly | Permalink | Reply | Top |

Ghost Dog  | Thu Oct-15-09 04:43 PM Response to Reply #14 |

| 40. (For the record) Goldman profit quadruples |

| Printer Friendly | Permalink | Edit | Reply | Top |

DemReadingDU  | Thu Oct-15-09 12:08 PM Response to Original message |

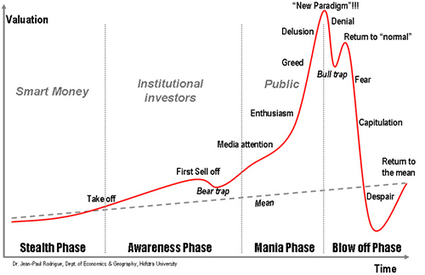

| 18. Bubble graph |

| Printer Friendly | Permalink | Reply | Top |

Hugin  | Thu Oct-15-09 01:26 PM Response to Reply #18 |

| 22. I'm leery of a market where the biggest talking point on Bubble Vision is PILs. |

| Printer Friendly | Permalink | Reply | Top |

DemReadingDU  | Thu Oct-15-09 01:32 PM Response to Reply #22 |

| 23. What is PILs? n/t |

| Printer Friendly | Permalink | Reply | Top |

Hugin  | Thu Oct-15-09 02:36 PM Response to Reply #22 |

| 26. PIL = Psychologically Important (Support) Level. |

| Printer Friendly | Permalink | Reply | Top |

DemReadingDU  | Thu Oct-15-09 03:00 PM Response to Reply #26 |

| 29. ah, yeh. |

| Printer Friendly | Permalink | Reply | Top |

Ghost Dog  | Thu Oct-15-09 04:08 PM Response to Reply #22 |

| 35. Well, you did see this at zerohedge? |

| Printer Friendly | Permalink | Edit | Reply | Top |

Hugin  | Thu Oct-15-09 05:13 PM Response to Reply #35 |

| 41. Why are you intent on harshing my buzz, man? |

| Printer Friendly | Permalink | Reply | Top |

Ghost Dog  | Thu Oct-15-09 05:31 PM Response to Reply #41 |

| 44. Hell, didn't want to harsh that much... |

| Printer Friendly | Permalink | Edit | Reply | Top |

Festivito  | Thu Oct-15-09 12:57 PM Response to Original message |

| 21. Debt: 10/13/2009 11,907,608,545,823.24 (UP 11,809,253,614.78) (Tue, yet a '10 surplus.) |

| Printer Friendly | Permalink | Reply | Top |

Festivito  | Fri Oct-16-09 06:07 AM Response to Reply #21 |

| 69. Debt: 10/14/2009 11,903,588,660,952.03 (DOWN 4,019,884,871.21) (Wed, yet in surplus.) |

| Printer Friendly | Permalink | Reply | Top |

| spotbird | Thu Oct-15-09 02:08 PM Response to Original message |

| 25. Let me see if I have this straight |

| Printer Friendly | Permalink | Reply | Top |

Dr.Phool  | Thu Oct-15-09 02:40 PM Response to Reply #25 |

| 27. Because it's not as painful as pulling your hair out? |

| Printer Friendly | Permalink | Reply | Top |

Ghost Dog  | Thu Oct-15-09 04:26 PM Response to Reply #25 |

| 36. It will end the way these things always end: |

| Printer Friendly | Permalink | Edit | Reply | Top |

Roland99  | Thu Oct-15-09 02:46 PM Response to Original message |

| 28. House Banking Panel Votes to Regulate Derivatives |

| Printer Friendly | Permalink | Reply | Top |

| mullard12ax7 (213 posts) | Thu Oct-15-09 04:32 PM Response to Reply #28 |

| 38. Where are the idiots saying there's no difference in parties? |

| Printer Friendly | Permalink | Reply | Top |

Dr.Phool  | Thu Oct-15-09 03:09 PM Response to Original message |

| 30. Recession ends in 79 metro areas! |

| Printer Friendly | Permalink | Reply | Top |

Demeter  | Thu Oct-15-09 03:54 PM Response to Reply #30 |

| 34. And Oddly Enough, No People! |

| Printer Friendly | Permalink | Reply | Top |

| neverforget | Thu Oct-15-09 04:30 PM Response to Reply #30 |

| 37. all you have to do it browse GD and GDP to see that there are many |

| Printer Friendly | Permalink | Reply | Top |

Dr.Phool  | Thu Oct-15-09 04:34 PM Response to Reply #37 |

| 39. Yeah, I just left a thread in LBN about SS COLA adjustments. |

| Printer Friendly | Permalink | Reply | Top |

AnneD (1000+ posts)  | Thu Oct-15-09 07:28 PM Response to Reply #39 |

| 53. Doing away with COLA... |

| Printer Friendly | Permalink | Reply | Top |

Ghost Dog  | Thu Oct-15-09 05:16 PM Response to Original message |

| 42. (Currencies watch) (1:) EU Wants Trichet, Almunia, Juncker Mtg With China |

| Printer Friendly | Permalink | Edit | Reply | Top |

Ghost Dog  | Thu Oct-15-09 05:21 PM Response to Reply #42 |

| 43. (2:) Sterling surges on talk QE may not be extended |

| Printer Friendly | Permalink | Edit | Reply | Top |

Ghost Dog  | Thu Oct-15-09 05:37 PM Response to Reply #42 |

| 45. (3:) U.S. Dollar Woes Boost China's Global Resource Investments |

| Printer Friendly | Permalink | Edit | Reply | Top |

Ghost Dog  | Thu Oct-15-09 06:21 PM Response to Reply #42 |

| 46. (4:) Greenspan worries about U.S. debt, not dollar slide |

| Printer Friendly | Permalink | Edit | Reply | Top |

Ghost Dog  | Thu Oct-15-09 06:35 PM Response to Reply #42 |

| 47. (5:) (Willie) |

| Printer Friendly | Permalink | Edit | Reply | Top |

Demeter  | Thu Oct-15-09 06:43 PM Response to Reply #47 |

| 49. Ross Perot's Sucking Sound |

| Printer Friendly | Permalink | Reply | Top |

Demeter  | Thu Oct-15-09 06:42 PM Response to Original message |

| 48. Fellow Marketeers, I Am reaching a Burnout |

| Printer Friendly | Permalink | Reply | Top |

Ghost Dog  | Thu Oct-15-09 07:23 PM Response to Reply #48 |

| 52. Disney! Of course... |

| Printer Friendly | Permalink | Edit | Reply | Top |

Demeter  | Thu Oct-15-09 08:06 PM Response to Reply #52 |

| 56. Disney is a good idea |

| Printer Friendly | Permalink | Reply | Top |

AnneD (1000+ posts)  | Thu Oct-15-09 07:50 PM Response to Reply #48 |

| 54. Let's do Hawaii... |

| Printer Friendly | Permalink | Reply | Top |

Demeter  | Thu Oct-15-09 08:05 PM Response to Reply #54 |

| 55. I Can Relate to That |

| Printer Friendly | Permalink | Reply | Top |

Ghost Dog  | Thu Oct-15-09 08:22 PM Response to Reply #55 |

| 58. That's unforgiveable. You were right. |

| Printer Friendly | Permalink | Edit | Reply | Top |

Demeter  | Thu Oct-15-09 10:39 PM Response to Reply #58 |

| 62. And a MUCH Shorter Flight! |

| Printer Friendly | Permalink | Reply | Top |

Ghost Dog  | Thu Oct-15-09 11:08 PM Response to Reply #62 |

| 64. Sure. Just don't fly via Madrid (Barajas) |

| Printer Friendly | Permalink | Edit | Reply | Top |

Ghost Dog  | Fri Oct-16-09 01:34 AM Response to Reply #64 |

| 67. (Or Lisboa, naturaly: |

| Printer Friendly | Permalink | Edit | Reply | Top |

Hugin  | Thu Oct-15-09 10:44 PM Response to Reply #55 |

| 63. What a tragic tale. |

| Printer Friendly | Permalink | Reply | Top |

| tclambert | Thu Oct-15-09 08:12 PM Response to Reply #48 |

| 57. It's pumpkin pie and apple cider season! |

| Printer Friendly | Permalink | Reply | Top |

Ghost Dog  | Thu Oct-15-09 08:52 PM Response to Reply #57 |

| 59. Or... Go with Dylan: |

| Printer Friendly | Permalink | Edit | Reply | Top |

Joe Chi Minh  | Thu Oct-15-09 09:47 PM Response to Reply #48 |

| 60. Play this brief hymn sung by Andrea Bocelli. Allow yourself to wallow in sadness for a while. |

| Printer Friendly | Permalink | Reply | Top |

Ghost Dog  | Thu Oct-15-09 10:10 PM Response to Reply #60 |

| 61. Yes. |

| Printer Friendly | Permalink | Edit | Reply | Top |

Joe Chi Minh  | Thu Oct-15-09 11:29 PM Response to Reply #61 |

| 65. Thanks for those beautiful arias. And what prophetic insight Huxley showed! |

| Printer Friendly | Permalink | Reply | Top |

Ghost Dog  | Thu Oct-15-09 11:50 PM Response to Reply #65 |

| 66. Yes indeed. Aldous Huxley, |

| Printer Friendly | Permalink | Edit | Reply | Top |

| MattSh | Fri Oct-16-09 04:52 AM Response to Reply #48 |

| 68. Gotta do Springsteen sometime... |

| Printer Friendly | Permalink | Reply | Top |

| Home » Discuss » Latest Breaking News |  |

Powered by DCForum+ Version 1.1 Copyright 1997-2002 DCScripts.com

Software has been extensively modified by the DU administrators

Important Notices: By participating on this discussion board, visitors agree to abide by the rules outlined on our Rules page. Messages posted on the Democratic Underground Discussion Forums are the opinions of the individuals who post them, and do not necessarily represent the opinions of Democratic Underground, LLC.

Home | Discussion Forums | Journals | Links | Store | Donate

About DU | Contact Us | Privacy Policy

Got a message for Democratic Underground? Click here to send us a message.

© 2001 - 2009 Democratic Underground, LLC